For those investors who are not making knee-jerk reactions to Bank of America headline news events and subsequently selling BAC shares absent thoughtful research and analysis, many value the stock based on an estimate of the company’s tangible book value of equity per share and then multiplying that value by what they believe is an appropriate multiple.

In the August 10, 2011, Bank of America’s conference call, world renowned investor Bruce Burkowitz provided further support to the notion the market is taking this approach with his comment to CEO Brian Moynihan, “You made reference to tangible book value in your answer and it sounds to me that you look at the change in tangible book value as the change in intrinsic value of the operation or a change in the shareholders wealth of the operation.”

Regardless of the merits of this approach, the reality is Bank of America shares are and will likely continue to trade on a price-to-tangible book value of equity basis until the company’s business outlook is clearer.

IMPORTANT NOTE: An appropriate framework for estimating the intrinsic value for shares of Bank of America (or any equity security) involves creating worst, best and base case scenarios with probabilities assigned to each of the outcomes. The weighted-average valuation under these scenarios would be the intrinsic value estimate for the security being valued. Based on our research and analysis, the likelihood of this scenario occurring – the worst case – for Bank of America is probably no greater than 10 to 15%. So , this is one step of a multi-stage process in evaluating the intrinsic value of BAC.

Tangible Equity Estimates

A footnote in Bank of America’s most recently filed 10-Q reminds us “tangible equity ratios and tangible book value per share of common stock are non-GAAP measures. Other companies may define or calculate these measures differently.” The primary source for data used in the calculation of BAC tangible book value for this report is Consolidated Financial Statements for Bank Holding Companies – FR Y-9C filed by Bank of America with the Board of Governors of the Federal Reserve System.

According to the Federal Reserve website, the FR Y-9C is “used to assess and monitor the financial condition of bank holding company organizations, which may include parent, bank, and nonbank entities. The FR Y-9C is a primary analytical tool used to monitor financial institutions between on-site inspections. The form contains more schedules than any of the FR Y-9 series of reports and is the most widely requested and reviewed report at the holding company level.”

[Note: You can find the most recent FR 9-YC for the Top 50 bank holding companies at http://www.ffiec.gov/nicpubweb/nicweb/Top50Form.aspx]

As of June 30, 2011, the reported tangible book equity for BAC was $12.76 (the 10-Q issued by the company actually reports $12.65). Calculations for the former estimate (all book values) are shown below:

June 30, 2011

Total bank holding company equity (EOP) $222,175,602

Less: Intangible Assets

Goodwill 71,073,519

Other intangible assets 21,817,866

92,891,385

Total tangible equity $129,284,217

Shares outstanding 10,133,190

Tangible equity per share $12.76

However, before accepting this calculation at face value, it’s important to take a closer look at one of the key factors that impact the tangible equity account: Provision for Loan Losses.

According to the June 30, 2011, SEC Form 10-Q, the reported Allowance for Loan Losses account stood at $37,213 million. Each quarter, management estimates the portion of loans which are unlikely to be repaid and makes a Provision for credit losses, which flow through to the Income Statement (thereby reducing earnings and, as a result, shareholder’s equity). These provisions are set aside and added to the Allowance for Loan Losses liability account on the Balance Sheet.

There are a number of reasons to believe reserves set aside by management already are sufficient to cover sizable loan losses over the next three (3) years. However, the purpose of this report is to arrive at a worst case scenario in the event they did not do so. That said, let’s take a closer look what happens if management proves to be overly optimistic and additional provisions are necessary: What is the potential magnitude of this error and how will it impact tangible equity per share?

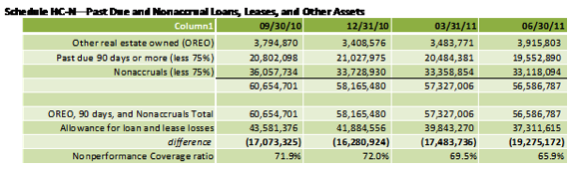

One conservative approach to determining the adequacy of the Allowance for Loan Losses for Bank of America is to take the reported Allowance for Loan Losses and compare it to the total of reported Other Real Estate Owned (OREO), Loans 90+ days Past Due, and Nonaccruals (less 75% of the latter two that are wholly or partially guaranteed; see Schedule HC-N: Past Due and Nonaccrual Loans on the FR 9-YC for more details).

Based on this analysis, it appears the Allowance for Loan Losses account should be increased by $19,275,172 million and the Shareholder’s Equity account reduced by a correspondingly identical amount. This results in an Adjusted Tangible Equity per share value of $10.85. Note that if Berkshire Hathaway exercises its 700 million in warrants from the deal announced August 25, 2011, the contributed capital of $5 billion is offset by the issuance of shares, which changes the Adjusted Tangible Equity per share value slightly downward to $10.62.

As an aside, Wall Street consensus estimates for BAC tangible equity per share are $12.85, $13.10, and $14.45 for periods ending 2011, 2012, and 2013, respectively. It’s important to be mindful of this as it contrasts with the highly conservative nature of the estimates used in this analysis.

On a related matter with the potential to affect negatively tangible equity per share, it is unclear how successful Bank of America will defend itself against claims resulting from the Countrywide Financial Corp. acquisition. A proposed $8.5 billion settlement Bank of New York claims would remove a substantial portion of this uncertainty; however, no one knows whether this will be approved as other claimants are challenging the settlement.

The argument that Bank of America artfully and legally limited its legal exposure is compelling. Nonetheless, there’s no guarantee claimants will be unsuccessful in piercing the corporate veil separating the two entities, subsequently leading to additional material, expenses for BAC. The same holds true for the recent AIG claims.

On the other hand, BAC’s recent significant sales of non-core assets (increasing Bank of America’s Tier 1 capital level by $3.5 billion and reducing its Tier 1 capital requirements by $16 billion in August), significant cost-cutting and restructuring efforts along with the liquidity afforded by $450 billion in cash and equivalents are not reflected in the adjusted tangible book value equity, either.

Regardless, we believe the highly conservative nature of the assumptions used in this analysis sufficiently account for one or more of these adverse events occurring.

Range of Price-to-Tangible Equity Ratios

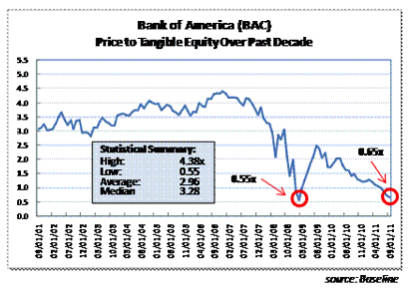

Shares of Bank of America closed at $6.98 on September 9, 2011, trading at an unadjusted 0.55x price-to-tangible equity ratio. The chart below shows the price-to-tangible equity value ratio for shares of BAC over the past decade:

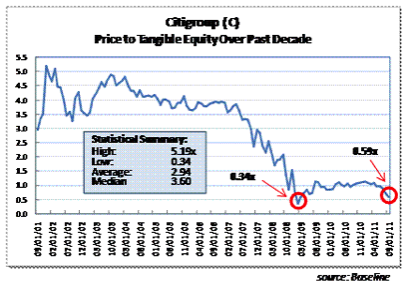

By way of comparison, the chart below illustrates Citigroup’s price-to-tangible equity valuation over the same time period:

Bank of America and Citigroup traded at the same average price-to-tangible equity multiple over the past decade with median, high and low multiples at similar levels. So while Citigroup may not be a great comparable, at least the market historically valued C’s and BAC’s tangible equity similarly. JP Morgan’s summary statistics, by comparison, averaged 2.36x, with a median, high, and low of 2.49x, 3.38x, and 1.14x, respectively. Recently, Bank of America was trading at 50% of the lowest level reached by JP Morgan over the past decade.

Worst Case Scenario: Intrinsic Value Estimate for Bank of America

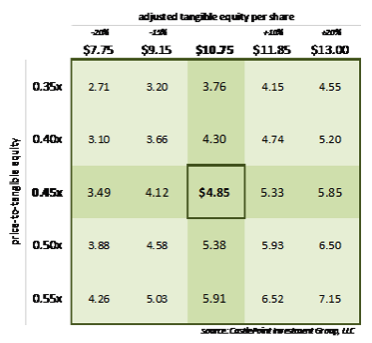

An adjusted baseline tangible book value of $10.75 is generated assuming a 50% probability that Berkshire Hathaway will exercise its warrants for 700 million shares of BAC. Taking an arbitrary but not wholly unrealistic – 20% discount the price-to-tangible equity ratio – tested twice by the market, once in March 2009 and again today – we arrive at an approximate 0.45x multiple.

The matrix below provides a sensitivity analysis under varying assumptions for adjusted tangible book value of equity per share and price-to-tangible equity valuations. As mentioned, the baseline for the worst-case scenario of $10.75 per share and 0.45x lead to a value of $4.85 ($10.75 x 0.45 = $4.85).

This leads to a worst-case scenario intrinsic value estimate of $4.85 per share which represents a 30% downside from current levels. It appears, based on this analysis, the market believes the appropriate price-to-tangible equity valuation of 0.55x is appropriate yet is also confident adjusted tangible equity per share will reach $13.00 – reaching the $7.15 value in the lower right-hand corner of the matrix.

Alternatively, if one were to assume shares of Bank of America will trade as low as Citigroup shares did in March 2009 leading to a 0.34x price-to-tangible equity ratio, the appropriate value (assuming the same adjusted tangible book value of equity of $10.75), the worst case scenario intrinsic value estimate for BAC would be approximately $3.76 ($10.75 x 0.35x = $3.76) found in the center column of the top row.

To reiterate our earlier comment regarding this report, a worst case scenario is one step of a multi-stage process in evaluating the intrinsic value of Bank of America shares. We believe the probability of a worst case scenario occurring for Bank of America is no greater than 10 to 15%. Using the baseline $4.85 per share intrinsic value estimate for BAC implies 30% downside risk for shares of Bank of America from its current level.

Disclosures:

One or more clients of CastlePoint Investment Group, LLC, own shares of Bank of America.

About the author:

John G. Alexander, CFA, is managing partner and portfolio manager for CastlePoint Investment Group. He earned an M.B.A. degree from the Wharton School of the University of Pennsylvania and a B.S. degree from Indiana University. He co-authored “The Future of Value Investing” published by the Journal of Investing in 2000. Please visit the CastlePoint website (www.castlepoint-inv.com) for additional information.

. Furthermore, making purchases of this nature typically increases the risk of a poor investment decision thereby mitigating, at least partially, the benefits of owning a portfolio of truly exceptional companies. Failing to adhere to a proven investment process – and buying securities that do not withstand the scrutiny of that process – is an almost certain recipe for mediocre investment returns at best and more likely a significant loss of capital.

. Furthermore, making purchases of this nature typically increases the risk of a poor investment decision thereby mitigating, at least partially, the benefits of owning a portfolio of truly exceptional companies. Failing to adhere to a proven investment process – and buying securities that do not withstand the scrutiny of that process – is an almost certain recipe for mediocre investment returns at best and more likely a significant loss of capital.

Nevertheless. the core investment approach and philosophy remain unchanged. The firm manages investment portfolios from two satellite offices, one in the San Francisco Bay Area and the other in Atlanta, GA. CastlePoint, with fewer than $10 million in assets, is an independent advisor currently exempt from SEC and State regulatory reporting requirements

Nevertheless. the core investment approach and philosophy remain unchanged. The firm manages investment portfolios from two satellite offices, one in the San Francisco Bay Area and the other in Atlanta, GA. CastlePoint, with fewer than $10 million in assets, is an independent advisor currently exempt from SEC and State regulatory reporting requirements