CASTLEPOINT PROFILE

CastlePoint’s proprietary investment model, independent-minded portfolio management team, and partnership culture of investing alongside our clients, are each important and differentiating aspects of our proven and historically successful approach to investing. CastlePoint began offering its flagship large cap equity product in 2005.

INVESTMENT PROFESSIONALS

DONALD L. TUTTLE, CFA

Senior Advisor

INVESTMENT APPROACH

CastlePoint’s approach to equity investing is based on the fundamental belief that markets are inefficient and mispriced securities can be systematically identified and opportunistically acquired using a time-tested, rigorous, and highly disciplined investment process. The firm uses the following broad tactics – an outgrowth of the investment philosophy – in the pursuit of this goal.

Limit downside risk by acquiring securities trading at a 40% or greater discount to the estimated intrinsic value of the company. Building a portfolio using this approach frequently requires one to be indifferent to the market consensus (contrarian) and highly opportunistic.

INVESTMENT PHILOSOPHY

The investment philosophy that serves as the cornerstone of CastlePoint’s investment strategy is based on thoroughly researched and well-established financial theory.

Market Overreaction & Behavioral Finance

Market participants tend to “overreact” to unexpected and dramatic news events.The natural tendency for many is to give more weight to recent information than prior data, regardless of the data’s significance. Cognitive errors and emotion-driven mistakes of this nature create exceptional investment opportunities for patient, long-term investors.

Focused Portfolio Construction

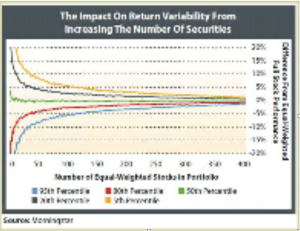

Investment return volatility, while employing CastlePoint’s disciplined risk controls, is historically comparable to or less than the relevant indices. Further, evidence suggests the benefit of diversification diminishes rapidly beyond 30 portfolio holdings. Therefore, CastlePoint’s concentrated investment strategy focuses its efforts exclusively on fewer securities believed to hold the greatest potential for price appreciation without increased risk.

Further, evidence suggests the benefit of diversification diminishes rapidly beyond 30 portfolio holdings. Therefore, CastlePoint’s concentrated investment strategy focuses its efforts exclusively on fewer securities believed to hold the greatest potential for price appreciation without increased risk.

Futility of Forecasting

There’s little evidence anyone can consistently make accurate financial forecasts. And if possible, the forecast would be of little value if it’s consistent with consensus expectations as this is accounted for in the current price. Forecasts must be accurate and differ from the consensus to be valuable. Consequently, CastlePoint relies heavily on rigorous analysis of historical financial statements when calculating our proprietary estimate of a company’s intrinsic value; we rely on neither interally generated nor Wall Street published analyst projections.

. Furthermore, making purchases of this nature typically increases the risk of a poor investment decision thereby mitigating, at least partially, the benefits of owning a portfolio of truly exceptional companies. Failing to adhere to a proven investment process – and buying securities that do not withstand the scrutiny of that process – is an almost certain recipe for mediocre investment returns at best and more likely a significant loss of capital.

. Furthermore, making purchases of this nature typically increases the risk of a poor investment decision thereby mitigating, at least partially, the benefits of owning a portfolio of truly exceptional companies. Failing to adhere to a proven investment process – and buying securities that do not withstand the scrutiny of that process – is an almost certain recipe for mediocre investment returns at best and more likely a significant loss of capital.

Nevertheless. the core investment approach and philosophy remain unchanged. The firm manages investment portfolios from two satellite offices, one in the San Francisco Bay Area and the other in Atlanta, GA. CastlePoint, with fewer than $10 million in assets, is an independent advisor currently exempt from SEC and State regulatory reporting requirements

Nevertheless. the core investment approach and philosophy remain unchanged. The firm manages investment portfolios from two satellite offices, one in the San Francisco Bay Area and the other in Atlanta, GA. CastlePoint, with fewer than $10 million in assets, is an independent advisor currently exempt from SEC and State regulatory reporting requirements